A | B | C | D | E | F | G | H | CH | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9

| This article is part of a series on the |

| Economy of the United States |

|---|

|

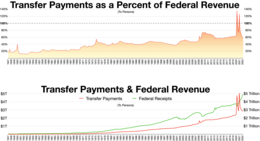

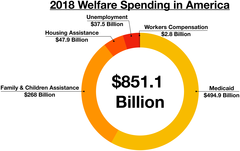

The United States spends approximately $2.3 trillion on federal and state social programs including cash assistance, health insurance, food assistance, housing subsidies, energy and utilities subsidies, and education and childcare assistance. Similar benefits are sometimes provided by the private sector either through policy mandates or on a voluntary basis. Employer-sponsored health insurance is an example of this.

American social programs vary in eligibility with some, such as public education, available to all while others, such as housing subsidies, are available only to a subsegment of the population. Programs are provided by various organizations on a federal, state, local, and private level. They help to provide basic needs such as food, shelter, education, and healthcare to residents of the U.S. through primary and secondary education, subsidies of higher education, unemployment and disability insurance, subsidies for eligible low-wage workers, subsidies for housing, Supplemental Nutrition Assistance Program benefits, pensions, and health insurance programs. Social Security, Medicare, Medicaid, and the Children's Health Insurance Program are prominent social programs.

Research shows that U.S. government programs that focus on improving the health and educational outcomes of low-income children are the most effective, with benefits substantial enough that the government may even recoup its investment over time due to increased tax revenue from adults who were beneficiaries as children.[2][3] Veto points in the U.S. structure of government make social programs in the United States resilient to fundamental change.[4][5]

Congressional funding

Not including Social Security and Medicare, Congress allocated almost $717 billion in federal funds in 2010 plus $210 billion was allocated in state funds ($927 billion total) for means tested welfare programs in the United States, of which half was for medical care and roughly 40% for cash, food and housing assistance. Some of these programs include funding for public schools, job training, SSI benefits and medicaid.[6] As of 2011[update], the public social spending-to-GDP ratio in the United States was below the OECD average.[7]

Total Social Security and Medicare expenditures in 2013 were $1.3 trillion, 8.4% of the $16.3 trillion GNP (2013) and 37% of the total Federal expenditure budget of $3.684 trillion.[8][9]

In addition to government expenditures, private welfare spending, i.e. social insurance programs provided to workers by employers,[10] in the United States is estimated to be about 10% of the U.S. GDP or another $1.6 trillion, according to 2013 OECD estimates.[11] In 2001, Jacob Hacker estimated that public and private social welfare expenditures constituted 21% and 13–14% of the United States' GDP respectively. In these estimates of private social welfare expenditures, Hacker included mandatory private provisions (less than 1% of GDP), subsidized and/or regulated private provisions (9–10% of GDP), and purely private provisions (3–4% of GDP).[12]

History

The first large-scale social policy program in the United States was assistance to Union Civil War veterans and their families.[13] The program provided pensions and disability assistance.[13] From 1890 to the early 1920s, the U.S. provided what Theda Skocpol characterized as "maternalist policies", as it provided pensions for widowed mothers.[13]

Historically, the United States has spent less on social welfare than European countries, but only in terms of gross public social welfare spending. The United States tended to tax lower-income people at lower rates, and relied substantially on private social welfare programs: "after taking into account taxation, public mandates, and private spending, the United States in the late twentieth century spent a higher share on combined private and net public social welfare relative to GDP than did most advanced economies.".[14] Spending varied between different states in the United States.[14]

Federal welfare programs

Colonial legislatures and later State governments adopted legislation patterned after the English "poor" laws.[15] Aid to veterans, often free grants of land, and pensions for widows and handicapped veterans, have been offered in all U.S. wars. Following World War I, provisions were made for a full-scale system of hospital and medical care benefits for veterans. By 1929, workers' compensation laws were in effect in all but four states.[16] These state laws made industry and businesses responsible for the costs of compensating workers or their survivors when the worker was injured or killed in connection with his or her job. Retirement programs for mainly State and local government paid teachers, police officers, and fire fighters—date back to the 19th century. All these social programs were far from universal and varied considerably from one state to another.

Prior to the Great Depression the United States had social programs that mostly centered around individual efforts, family efforts, church charities, business workers compensation, life insurance and sick leave programs along with some state tax supported social programs. The misery and poverty of the Great Depression threatened to overwhelm all these programs. The severe Depression of the 1930s made Federal action necessary,[17] as neither the states and the local communities, businesses and industries, nor private charities had the financial resources to cope with the growing need among the American people.[18] Beginning in 1932, the Federal Government first made loans, then grants, to states to pay for direct relief and work relief. After that, special Federal emergency relief like the Civilian Conservation Corps and other public works programs were started.[19] In 1935, President Franklin D. Roosevelt's administration proposed to Congress federal social relief programs and a federally sponsored retirement program. Congress followed by the passage of the 37 page Social Security Act, signed into law August 14, 1935 and "effective" by 1939—just as World War II began. This program was expanded several times over the years.

Economic historians led by Price Fishback have examined the impact of New Deal spending on improving health conditions in the 114 largest cities, 1929–1937. They estimated that every additional $153,000 in relief spending (in 1935 dollars, or $2.7 million in 2023 dollars) was associated with a reduction of one infant death, one suicide, and 2.4 deaths from infectious disease.[20][21]

War on Poverty and Great Society programs (1960s)

Virtually all food stamp costs are paid by the federal government.[22] In 2008, 28.7 percent of the households headed by single women were considered poor.[23]

Welfare reform (1990s)

Before the Welfare Reform Act of 1996, welfare assistance was "once considered an open-ended right," but welfare reform converted it "into a finite program built to provide short-term cash assistance and steer people quickly into jobs."[24] Prior to reform, states were given "limitless"[24] money by the federal government, increasing per family on welfare, under the 60-year-old Aid to Families with Dependent Children (AFDC) program.[25] This gave states no incentive to direct welfare funds to the neediest recipients or to encourage individuals to go off welfare benefits (the state lost federal money when someone left the system).[26] Nationwide, one child in seven received AFDC funds,[25] which mostly went to single mothers.[22]

In 1996, under the Clinton administration, Congress passed the Personal Responsibility and Work Opportunity Reconciliation Act, which gave more control of the welfare system to the states, with basic requirements the states need to meet with regards to welfare services. Some states still offer basic assistance, such as health care, food assistance, child care assistance, unemployment, a few offering cash aid, and one or two offering housing assistance, depending on the state and the circumstance. After reforms, which President Clinton said would "end welfare as we know it,"[22] amounts from the federal government were given out in a flat rate per state based on population.[26]

Each state must meet certain criteria to ensure recipients are being encouraged to work themselves out of welfare. The new program is called Temporary Assistance for Needy Families (TANF).[25] It encourages states to require some sort of employment search in exchange for providing funds to individuals, and imposes a five-year lifetime limit on cash assistance.[22][25][27] The bill restricts welfare from most legal immigrants and increased financial assistance for child care.[27] The federal government also maintains a contingency $2 billion TANF fund (TANF CF) to assist states that may have rising unemployment.[25] The new TANF program expired on September 30, 2010, on schedule with states drawing down the entire original emergency fund of $5 billion and the contingency fund of $2 billion allocated by ARRA. Reauthorization of TANF was not accomplished in 2011, but TANF block grants were extended as part of the Claims Resolution Act of 2010 (see Temporary Aid for Needy Families for details).

Following these changes, millions of people left the welfare rolls (a 60% drop overall),[27] employment rose, and the child poverty rate was reduced.[22] A 2007 Congressional Budget Office study found that incomes in affected families rose by 35%.[27] The reforms were "widely applauded"[28] after "bitter protest."[22] The Times called the reform "one of the few undisputed triumphs of American government in the past 20 years."[29] However, more recent studies have found that the reforms increased deep poverty by 130–150%.[30][31]

Legal immigrants in the United States were impacted in two ways by The Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA). First, it directly denied Medicaid benefits to immigrants entering the U.S. after August 1996. Second, it restricted immigrant access to TANF, which had been a significant indirect pathway to Medicaid enrollment. Together, this led to a significant decrease in immigrants' usage of means-tested programs like TANF, Medicaid, and Food Stamps following the enactment of the Federal law. This formed negative stigma concerning the usage of welfare benefits[32] as some associated those who used welfare to be lazy, taking advantage of the system, and uneducated. This raised concerns that the stigma associated with PRWORA might have deterred even eligible immigrants from applying for benefits, even though many remain eligible and in dire need of health, nutrition, and other services. These effects originate, among other things, in confusion on the part of immigrants and providers about who is eligible for benefits and in fears of it affecting their immigration status.

A study by the Urban Institute encapsulated this effect on the immigrants in Los Angeles County. Applications that were approved by legal noncitizen families for Medi-Cal and Temporary Assistance for Needy Families dropped 71 percent between January 1996 and January 1998.[33]

Critics of the reforms sometimes point out that the massive decrease of people on the welfare rolls during the 1990s wasn't due to a rise in actual gainful employment in this population, but rather, was due almost exclusively to their offloading into workfare, giving them a different classification than classic welfare recipient. The late 1990s were also considered an unusually strong economic time, and critics voiced their concern about what would happen in an economic downturn.[22]

National Review editorialized that the Economic Stimulus Act of 2009 will reverse the welfare-to-work provisions that Bill Clinton signed in the 1990s, and will again base federal grants to states on the number of people signed up for welfare rather than at a flat rate.[26] One of the experts who worked on the 1996 bill said that the provisions would lead to the largest one-year increase in welfare spending in American history.[29] The House bill provides $4 billion to pay 80% of states' welfare caseloads.[25] Although each state received $16.5 billion annually from the federal government as welfare rolls dropped, they spent the rest of the block grant on other types of assistance rather than saving it for worse economic times.[24]

| Spending on largest Welfare Programs Federal Spending 2003–2013*[34] | ||

|---|---|---|

|

| ||

| Federal Programs |

Spending 2003* |

Spending 2013* |

| Medicaid and CHIP Grants to States | $201,389 | $266,565 |

| Food Stamps (SNAP) | 61,717 | 82,603 |

| Earned Income Tax Credit (EITC) | 40,027 | 55,123 |

| Supplemental Security Income (SSI) | 38,315 | 50,544 |

| Housing assistance | 37,205 | 49,739 |

| Child Nutrition Program | 13,558 | 20,842 |

| Support Payments to States, TANF | 28,980 | 20,842 |

| Feeding Programs (WIC & CSFP) | 5,695 | 6,671 |

| Low Income Home Energy Assistance | 2,542 | 3,704 |

| Notes: * Spending in millions of dollars | ||

Timeline

The following is a short timeline of welfare in the United States:[35]

1880s–1890s: Attempts were made to move poor people from work yards to poor houses if they were in search of relief funds.

1893–1894: Attempts were made at the first unemployment payments, but were unsuccessful due to the 1893–1894 recession.

1932: The Great Depression had gotten worse and the first attempts to fund relief failed. The "Emergency Relief Act", which gave local governments $300 million, was passed into law.

1933: In March 1933, President Franklin D. Roosevelt pushed Congress to establish the Civilian Conservation Corps.

1935: The Social Security Act was passed on June 17, 1935. The bill included direct relief (cash, food stamps, etc.) and changes for unemployment insurance.

1940: Aid to Families With Dependent Children (AFDC) was established.

1964: Johnson's War on Poverty is underway, and the Economic Opportunity Act was passed. Commonly known as "the Great Society"

1996: Passed under Clinton, the "Personal Responsibility and Work Opportunity Reconciliation Act of 1996" becomes law.

2013: Affordable Care Act goes into effect with large increases in Medicaid and subsidized medical insurance premiums go into effect.

Types

Means-tested

| 79 Means Tested Programs in U.S. (2011)[36] | |||

|---|---|---|---|

| Programs | Federal Spending* | State Spending* | Total Spending* |

| TOTAL cost in (billions) (2011) | $717 | $210 | $927 |

| Social Security OASDI (2013) | $785 | ||

| Medicare(2013) | $574 | ||

| TOTAL all programs (billions) | $2,286 | ||

| CASH ASSISTANCE (millions) | |||

| SSI/Old Age Assistance | 56,462 | 4,673 | 61,135 |

| Earned Income Tax Credit (refundable portion) | 55,652 | 55,652 | |

| Refundable Child Credit | 22,691 | 22,691 | |

| Make Work Pay Tax Credit (Refundable Portion) | 13,905 | 13,905 | |

| Temporary Assistance for Needy Families (TANF, old AFDC) | 6,883 | 6,877 | 13,760 |

| Foster Care Title IVE | 4,456 | 3,921 | 8,377 |

| Adoption Assistance Title IVE | 2,362 | 1,316 | 3,678 |

| General Assistance Cash | 2,625 | 2,625 | |

| Refugee Assistance | 168 | 168 | |

| General Assistance to Indians | 115 | 115 | |

| Assets for Independence | 24 | 24 | |

| CASH TOTAL | 162,718 | 19,412 | 182,130 |

| MEDICAL | |||

| Medicaid | 274,964 | 157,600 | 432,564 |

| SCHIP State Supplemental Health Insurance Program | 8,629 | 3,797 | 12,426 |

| Medical General Assistance | 6,966 | 6,966 | |

| Consolidated Health Center/Community Health Centers | 1,481 | 1,481 | |

| Maternal & Child Health | 656 | 492 | 1,148 |

| Medical Assistance to Refugees | 168 | 168 | |

| Healthy Start | 104 | 104 | |

| MEDICAL TOTAL | 289,817 | 168,855 | 458,672 |

| FOOD | |||

| Food Stamps, SNAP | 77,637 | 6,987 | 84,624 |

| School Lunch Program | 10,321 | 10,321 | |

| WIC Women, Infant and Children Food Program | 6,787 | 6,787 | |

| School Breakfast | 3,076 | 3,076 | |

| Child Care Food Program | 2,732 | 2,732 | |

| Nutrition Program for the Elderly, Nutrition Service Incentives | 820 | 139 | 959 |

| Summer Program | 376 | 376 | |

| Commodity Supplemental Food Program | 196 | 196 | |

| TEFAP Temporary Emergency Food Program | 247 | 247 | |

| Needy Families | 60 | 60 | |

| Farmers' Market Nutrition Program | 23 | 23 | |

| Special Milk Program | 13 | 13 | |

| FOOD TOTAL | 102,288 | 7,127 | 109,415 |

| HOUSING | |||

| Section 8 (housing) (HUD) | 28,435 | 28,435 | |

| Public Housing (HUD) | 8,973 | 8,973 | |

| Low Income Housing Tax Credit for Developers | 6,150 | 6,150 | |

| Home Investment Partnership Program (HUD) | 2,853 | 2,853 | |

| Homeless Assistance Grants (HUD)

Zdroj:https://en.wikipedia.org?pojem=Social_programs_in_the_United_States Text je dostupný za podmienok Creative Commons Attribution/Share-Alike License 3.0 Unported; prípadne za ďalších podmienok. Podrobnejšie informácie nájdete na stránke Podmienky použitia.

Analytika

Antropológia Aplikované vedy Bibliometria Dejiny vedy Encyklopédie Filozofia vedy Forenzné vedy Humanitné vedy Knižničná veda Kryogenika Kryptológia Kulturológia Literárna veda Medzidisciplinárne oblasti Metódy kvantitatívnej analýzy Metavedy Metodika Text je dostupný za podmienok Creative

Commons Attribution/Share-Alike License 3.0 Unported; prípadne za ďalších

podmienok. www.astronomia.sk | www.biologia.sk | www.botanika.sk | www.dejiny.sk | www.economy.sk | www.elektrotechnika.sk | www.estetika.sk | www.farmakologia.sk | www.filozofia.sk | Fyzika | www.futurologia.sk | www.genetika.sk | www.chemia.sk | www.lingvistika.sk | www.politologia.sk | www.psychologia.sk | www.sexuologia.sk | www.sociologia.sk | www.veda.sk I www.zoologia.sk | |||